Product

Goal

Increase the availability of high quality ethical ISAs to students globally through increased investment by reducing the costs and risks of investing.

Overview

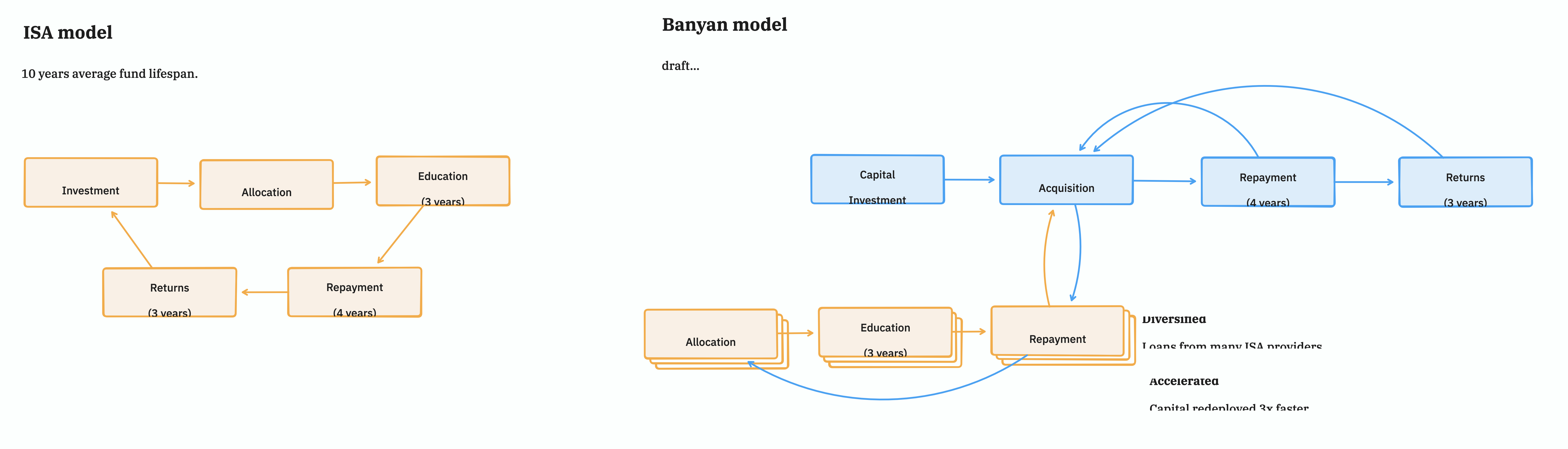

https://www.tldraw.com/f/8LIVXn0l96IdqYIX0jlmW?d=v23.-1435.2638.2239.page

The Banyan model acquires loans from ISA providers allowing them the immediately bank returns, and

- Capital Investment

- External investment funding is raised for the acquisition of ISA loans.

- Acquisition

- Loans are acquired from the ISA providers at a premium once the full loan amount is known. Banyan pays a discount on the future value of the loan since the ISA provider has transferred risk to Banyan.

- Example: ISA lends $12k to a student. Banyan buys the loan for $13k on the basis that the future value of the ISA will be greater than $13k. The $1k difference is upside that is immediately realized by the ISA provider.

- Loans are acquired from the ISA providers at a premium once the full loan amount is known. Banyan pays a discount on the future value of the loan since the ISA provider has transferred risk to Banyan.

- Repayment

- Returns

Acquisition

Thoughts on the discount on FV

- ISA providers has accumulated debt

- Year 1 - $3k

- Year 2 - $3k + interest on $3k

- Year 3 - $3k + interest on $6k

Total Borrowings (local)- the total amount of borrowings excluding any paymentsTotal Repayments (local)- the total amount of repayments made to date (would impact repayment cap)

- Loan has a repayment cap

Repayment cap (local)- expressed in local currency - total borrowings, less any repayments that are applicable to the repayment cap

Comparison: ISA Model

Purchase debt

- Banyan purchases ISA loans from ISA providers

- pricing - ISA lends USD $12k, and we buy the loan with a premium (e.g. USD $13k - exchange future earnings and risk for immediate liquidity)

- ISA provider gets liquidity and upside

- guarantee fee (cover a fixed % default rate) is deducted

- premium calculation?

- Fixed: Loan term (120 payments) * fixed amount

- Variable: X% of loan value

- pricing - ISA lends USD $12k, and we buy the loan with a premium (e.g. USD $13k - exchange future earnings and risk for immediate liquidity)

Harvesting repayments

- Banyan pays fees to:

- ISA providers to manage each loan (fixed fee per month?)

- Brightlights to manage investments (percentage fee per month)

- ISA providers pay Banyan:

- all repayments

- ISA providers charge Banyan:

- administration fee (collection, reporting etc)

Risks to Banyan

- defaults/delinquency higher than in the past/expected

- guarantee fee covers some of this

Risks to ISA providers

- cost of administering the loan is more than the profit from selling the loan

Other risks

- FX - we transact in USD, but the loan and payments are based in local currency

Returning

Returns used to purchase more loans, or paid to exiting investors

Foreign Exchange

FX is considered from two perspectives:

- portfolio (hedging)

- Relative to the USD, AUD is generally correlated with emerging market currencies. Assuming this correlation continues, Banyan could use an AUD-USD hedge to hedge against depreciation of African and LATAM currencies.

- transaction (service providers and contracts)

- Transaction fees can be avoided through re-investment and avoiding unnecessary FX movements.

- Transaction fees can be minimized by using providers that can pair our transaction with a transaction in the opposite direction.